This week, the total inventory of construction steel shifted from a decline to an increase, marking a turning point. Specifically, rebar inventory increased by 2.12% WoW, while wire rod inventory decreased by 1.31% WoW. Entering January, the macro perspective entered a vacuum period, reducing its impact on market sentiment. Meanwhile, winter stockpiling sentiment was relatively low this year, and spot price fluctuations were minimal. Industry side, year-end maintenance increased among steel mills in north China, while some mills in south China resumed production but also controlled output. Most EAF steel mills began their winter break in mid-January. The production of construction steel is expected to decline further, while demand is gradually weakening. With supply decreasing and demand stagnating, the total inventory of construction steel shifted from a decline to an increase this week.

This week, the total rebar inventory stood at 3.7908 million mt, up 78,600 mt WoW, an increase of 2.12% (previous value: -0.75%). YoY, it decreased by 2.2376 million mt, a decline of 37.12% (previous value: -36.75%).

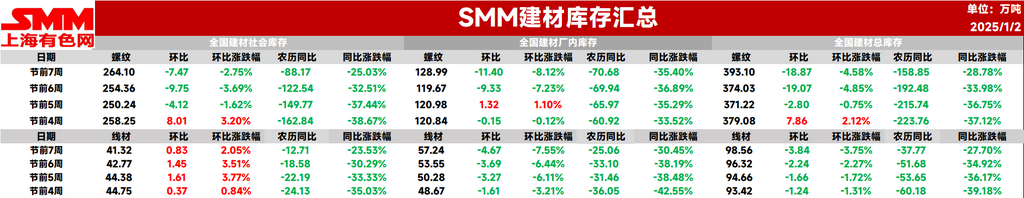

Table 1: Overview of Rebar Inventory

Source: SMM

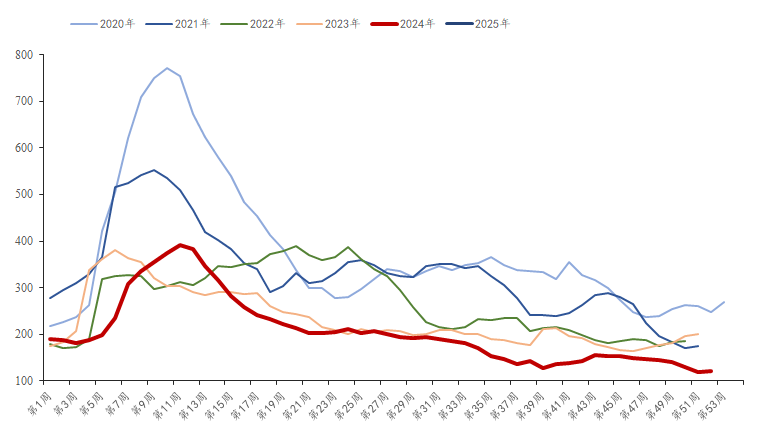

This week, in-plant rebar inventory was 1.2084 million mt, down 1,500 mt WoW, a decline of 0.12% (previous value: +1.1%). YoY, it decreased by 609,200 mt, a decline of 33.52% (previous value: -35.29%). Year-end maintenance increased across many domestic steel mills, leading to a decline in production, while in-plant inventory remained relatively stable.

Chart-1: Rebar In-Plant Inventory Trends, 2019-2024

Source: SMM

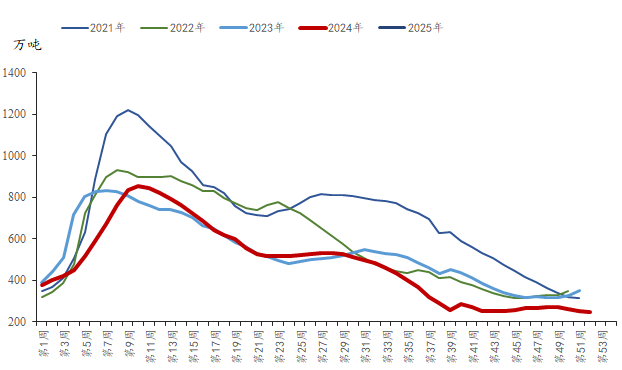

This week, rebar social inventory was 2.5825 million mt, up 32,000 mt WoW, an increase of 3.2% (previous value: -1.62%). YoY, it decreased by 1.6284 million mt, a decline of 38.67% (previous value: -37.44%). Entering January, end-use demand further weakened, and winter stockpiling sentiment was significantly lower than in previous years. Market activity was relatively subdued, and the turning point for rebar social inventory appeared this week, with a slight increase in social inventory.

Chart-2: Rebar Social Inventory Trends, 2019-2024

Source: SMM

Looking ahead, according to the SMM survey, EAF steel mills in Fujian have already started their winter break, while most other regions will begin between January 10-15. Blast furnace steel mills in north China increased year-end maintenance, while some mills in south China resumed production but also controlled output. Overall production is expected to continue decreasing. Demand side, winter stockpiling enthusiasm is weak this year, reducing resource circulation in the market. End-use demand in north China has mostly halted, and in south China, it will gradually cease after the 10th. The effective sales period in the market is relatively short. As the Chinese New Year approaches, market activity is expected to decline further, spot prices are likely to stabilize, and demand and trading volume will decrease. Total construction steel inventory is expected to continue increasing next week.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)